The biggest day on India’s policy calendar had a slew of announcements directed at the middle class and the rural sector, but few that shone a spotlight on the burgeoning startup ecosystem in India. India’s payment industry, however, has much to cheer about with the proposed regulatory board under RBI, allowing for more representation from industry experts in finalising policies for digital payments in India.

Although this year’s budget had direct cash handouts for the startup community a few more away, a remarkable announcement has been made in the form of taxes for operating companies in the form of emerging businesses in India.

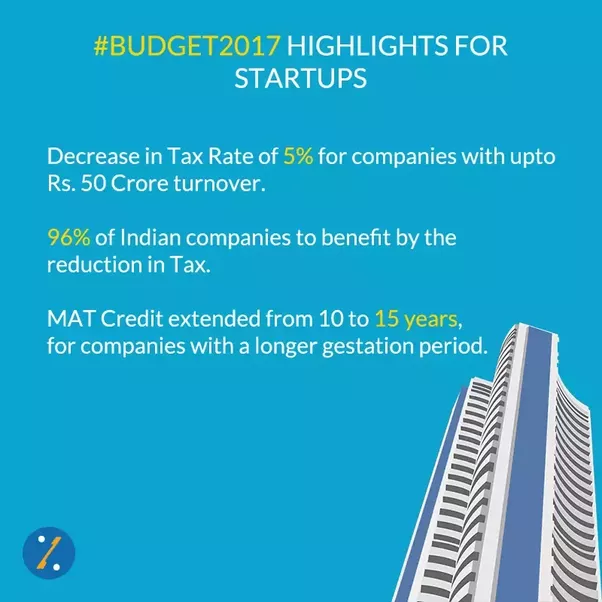

“Period of claiming profit-linked tax exemption for startups has been increased to 7 years from 5 years earlier,” said Finance Minister Arun Jaitley in his fourth Union Budget speech on February 1. “The rate of tax for MSMEs with a turnover of less than Rs 50 crore also has been reduced to 25%, a move that is estimated to benefit 6.67 lakh companies in India,” he added.

However, in the few quarters of the budget, disappointment was not mentioned about Angel Taxes in the early days of the initial phase, while others had also said that in other areas, even in the startup ecosystem with financial services, less within Is inclusive.

With announcements anchored around radical domestic policy action – conclusion – changing the concentration of Budget 2017, initial reactions from numerous stakeholders within the entrepreneurship landscape pointed to a for the most part positive trend towards larger adoption of initiatives for the world.

“This year’s Budget offers a mixed bag for the startup community – there are some hits and some misses. Some of the positive moves include:

- Increase in tax relief period for startups from 3 to 7 years. Since most startups take the time to make profits, it is certainly a positive move in the right direction.

- Aligned with this is often the flexibility for a startup to hold forward losses if the founder is concerned. This allows companies to take real advantage of tax relief and also help them get private equity investment.

- Tax reduction revenues for companies with the turnover of up to Rs 50 crore to 25% is a positive move as well.

- It also comes as a relief that MAT can be carried forward for 15 years by companies as against 10 years allowed earlier.

The main positive facet for startups is that the tax reduction of 25%. In most companies, we invest in which less than 50 crores are traded, so it comes as a huge relief to us. ”

Payment of another positive step is to be a regulatory body because it is pushing for the area and new ways of handling things are used. Also, the government is trying to strengthen Negotiable Instruments Act which is a tool to recover loans. This will help fin tech companies as they do not have an offline infrastructure to handle this.

We were expecting specific peer-to-peer lending guidelines or the fact that they will enable alternate lending besides bank lending which has not come through and that is a disappointment.”