The Indian economy is traditionally referred to as a cash-based economy, nowadays cashless is the most popular and most circulated – on November 8, 2016. 500 and Rs. 1000 currency notes were declared as legal tender lost their position. The Revolutionary Movement, Prime Minister of India- Narendra Modi had adopted the country to eliminate the evils of black money. With this step, in front of a number of ideas, and against similar campaigns and campaigns highlighting the opposition also came out against them.

But gradually a noticeable change is taking place, digitization. India has been seen to use online transactions, mobile wallets, use of card transactions, to meet day-to-day requirements. Below are some examples that show that the doors have been opened for digitization for digitalization.

First Digital and Cashless Village of India

India is a cash-based economy, it is definitely a matter of common thinking for the general public to face difficulties for the common people. But in some places actually did not believe some people. 60 meters from the northern city of Ahmedabad set a perfect example of a village named Akodara, which was adopted by ICICI Bank last year under ‘Digital India’ program. Most of the 1200 people living there have welcomed the heart while embracing the online transaction. He has adopted mobile banking as his perfect partner for his daily behavior.

A Big Growth in online Traffic

Using the mode of online and cashless payments, India relies more heavily on cash than other developed economies. But with the recent work of resensitization, the online crowd has increased. According to the report, PayTm experienced an increase of 1000 percent by adding wallet and registered an increase of 400 percent in the transaction value of offline payments. While Ola Money increased its recharges by 1500 percent in 102 cities of its operation, from 8th November 2016 to 12:00 pm till 8:30 pm. After the announcement was announced, Riswerpe increased by 150 percent in the morning, which increased by 200 percent till noon.

Retailers are going to online transaction

Not only online platforms such as PayTm, Olmany, and Razorpe are encouraging people to adopt online transactions, but offline retailers have encouraged people. This step is supported by many large retailers by arranging a cashless payment mode for customers. For example, the CEO of Kishore Biyani Future Group, which operates the Big Bazaar, is the largest retail chain in India that encourages people to pay through the card. They are also planning to present checks, debit cards, digital payments and gift cards to support the movement and encourage people to ‘go digital’.

Derivation should not be seen as a roadblock, but in the form of rapid fuel for digitization, an opportunity is opening up the way to go digital and promote the progress of the economy. Only in the long run have the benefits of elimination, the government is taking all the necessary steps and actions to fulfill the demand of money and ensure smooth flow of new currency.

How Demonetization is a big boost for Digital India

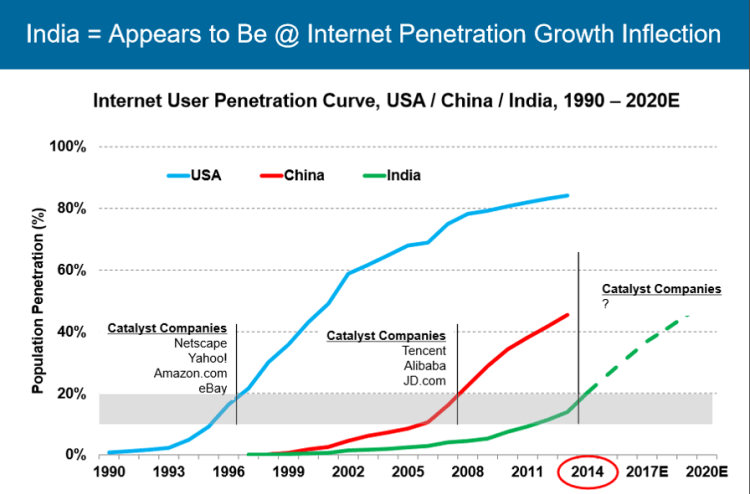

It is time for a customized strategy to address Tier 3,4,5 geographies to capture 80-100 million new users in India.

Demonetization of high-value currency notes in India will provide a big boost for Digital India. Reduction in cash transactions will help many digital and plastic transactions such as checks, credit cards, and mobile wallet.

As Indians start getting used to handling digital money, their trust in anything online and mobile will get a big boost. If you can trust mobile and Internet with your money, everything else on mobile and the Internet will begin to get trusted as well. More Bank accounts will be opened by citizens as they’ll start keeping their money in a Bank. More and more online transactions will take place not only in urban areas but also in tier 3,4,5 geographies and rural areas.

New online users will need a good understanding of the terms and conditions of usage and will demand more information on the products and services they’re buying without being able to touch and feel. This information must be made available in simple layman language and vernacular, something that simple people will be able to understand and trust.

Businesses that are able to develop and implement a comprehensive strategy to address Tier 3,4,5 geographies will find favor with the next 80-100 million new users that are likely to attempt small online transactions carefully. The companies that are able to win the trust of these users and provide them quality products and services will have the first mover advantage.

Credit – Process9, Faber infinite