Objective

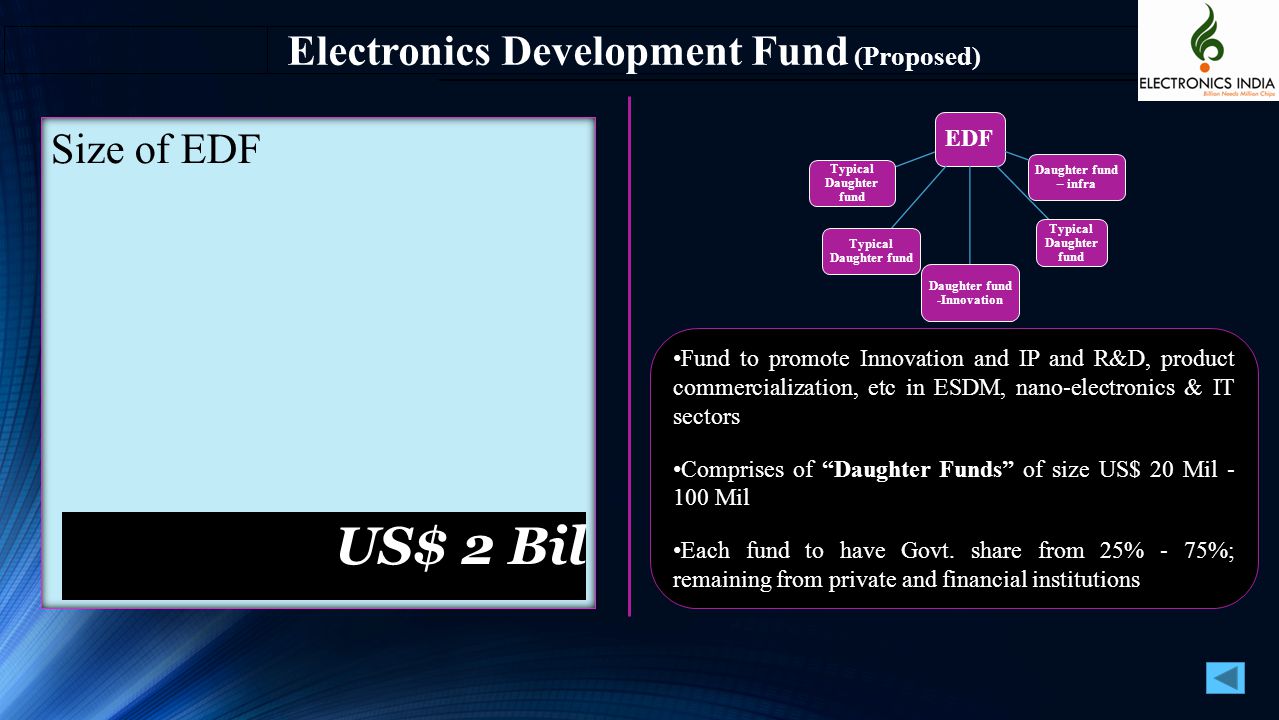

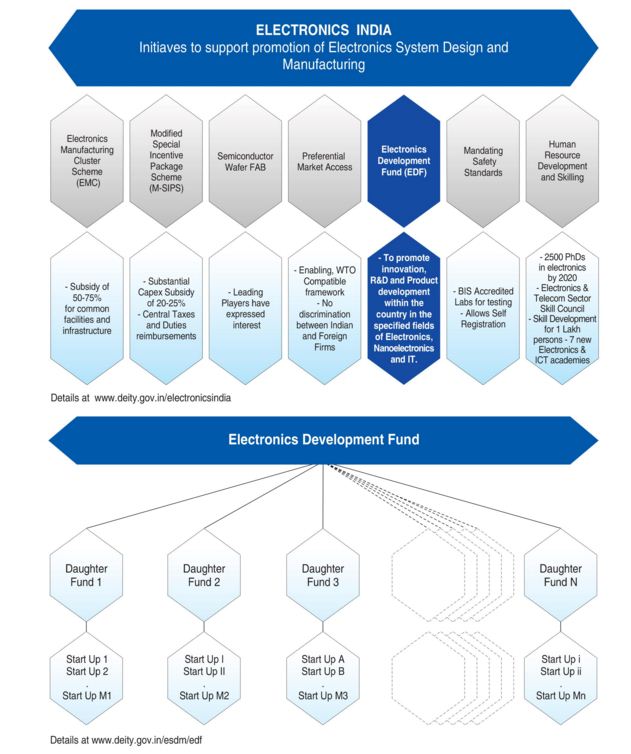

As part of the “digital India” government agenda, by 2020, it has been envisaged to develop the electronics system design and manufacturing (ESDM) area to achieve “Net Zero Import”. Setting up of Electronic Development Fund (EDF) is one of the important strategies which would enable creating a vibrant ecosystem of innovation, research and development (R&D) and with active industry involvement. It is with this objective that an Electronic Development Fund (EDF) is set up as a “Fund of Funds” to participate in professionally managed “Daughter Funds” In return, in the field of electronics, nano-electronics and information technology (IT) in the field of development, new technologies will provide risk capital to the companies. The EDF will also help attract venture funds, angel funds and seed funds towards R&D and innovation in the specified areas. This will help in the preparation of battery funds and fund managers, who will be looking for good start-ups (potential winners) and they have to choose based on professional ideas.

Target Beneficiaries

Any daughter Fund is registered in India and obeys relevant rules and regulations applicable to such funds, in which SEBI rules are included in venture funds and have been established to achieve the above-mentioned objectives, He will be eligible to support the EDF.

Fund Manager

CANBANK Venture Capital Funds Ltd. (CVCFL) is the Fund Manager for EDF. The role of EDF’s Fund Manager is to consider the request from the applicant Venture Fund, Angel Funds, and Seed Fund and make recommendations to the Electronics and IT departments of the Government of India. Based on the approval of the CVCFL Electronics Department and the IT department, the individual beneficiary daughter will also participate in the fund.

Sectors

- Electronic Systems Design & Manufacturing (ESDM)

- Nano-electronics

- Information Technology & related sectors

VISION and MISSION

To develop the ESDM sector to achieve Net-zero imports by 2020. Provide risk capital to companies developing new technologies in the area of electronics, nano-electronics and Information Technology (IT). EDF will also help attract enterprise funds, angel funds and seed funds for R & D and innovation in specific areas. This will help in the preparation of battery funds and fund managers, who will be looking for good start-ups (potential winners) and they have to choose based on professional ideas.

Electronics Development Fund Policy

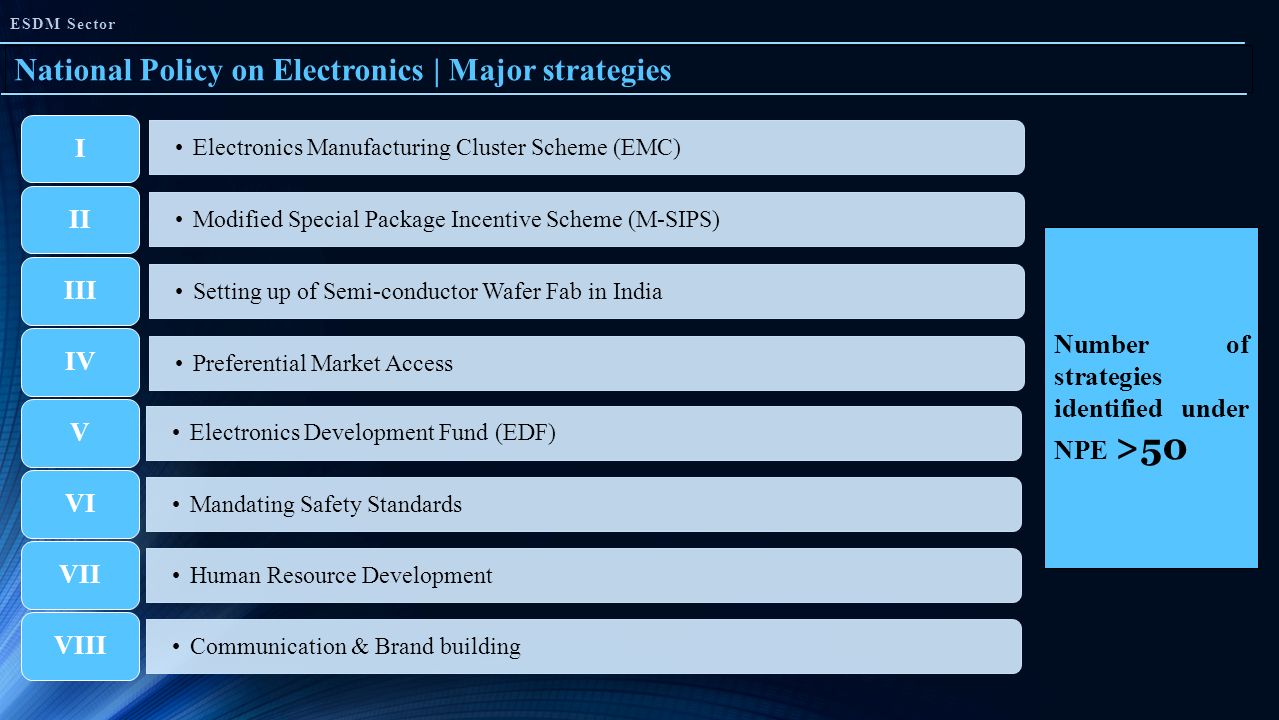

India is taking several initiatives to promote the electronics design and manufacturing in the country. A major characteristic of this sector is the high velocity of technological change. Intellectual Property is possibly the most critical determinant of success for a technology company.

The Electronics Development Fund Policy provides a framework for setting up an Electronics Development Fund (EDF) as a fund, which will promote R & D and innovation,

Technology sectors like electronics, IT and nano-electronics. EDF will support Venture Funds and Angel Funds, which will be professionally managed and are dedicated to these sectors.

EDF Policy, therefore, enables the creation of an ecosystem for providing risk capital to both industry and academia to undertake research and development in these technology areas. It will, in the process, enrich the intellectual property in the country and encourage more entrepreneurs towards product and technology development.

EDF is being promoted as a Digital India initiative by Department of Electronics and Information Technology (DITI), Ministry of Communications & Information Technology, Government of India.

Policy for setting up of Electronics Development Fund (EDF)

Background

Electronics permeates in all sectors of the economy and has great economic and strategic importance. A major characteristic of the electronics sector is the importance of R&D and innovation due to the high velocity of technology change. Intellectual Property is the most critical differentiator and a determinant of success for an electronics company. The Government’s “Digital India” program has conceived to develop electronics system design and manufacturing (ESDM) with the aim of establishing pure zero import and electronics development fund (EDF) as a step in this direction. The National Policy on Electronics (NPE) also envisages setting up of an EDF. The NPE proposes that EDF will be set up as a “Fund of Funds” to participate in “Daughter Funds”. This Policy, hereinafter called the “EDF Policy”, is proposed to realize the aforesaid objectives.

Objective

The aim of the EDF policy is to support the Betty Funds with the introduction of the initial stage Angel Fund and Venture Fund in the field of electronics system design and manufacturing, nanotechnology and IT. Supported Daughter Funds will promote innovation, research and development and product development in ESDM, nanotechnology and specific areas of IT. They will also support the acquisition of foreign companies and technologies for products imported into India in large volume. The main goal of daughter funding will be to develop domestic design capabilities. Supported daughter funds will create the resource pool of IP within specific areas of the country.

Target Beneficiaries

Any daughter fund which is registered in India and adheres to relevant rules and regulations, including the SEBI rules on the above funds and has been established to achieve the above-mentioned objectives, will be eligible for support from the EDF.

Salient Features of EDF Policy

- The Electronics Development Fund (EDF) shall be created in a financial institution like SIDBI or a similar organization.

- The EDF should invest in daughter funds which will invest in ESDM, nanotechnology and IT sector. This fund should act as a catalyst to attract private enterprise fund investors to attract such daughter funds.

- EDF’s involvement in a daughter fund will be on an exclusive basis.

- The corpus of a Daughter Fund may be determined by market requirements and the capacity of its Fund Manager to cater to the requirements of the Fund. The EDF typically takes minority participation in daughter Fund. The entire responsibility of raising the fund, investing and monitoring individual investments would be the responsibility of the Fund Manager of the Daughter Fund.

- Since the government is only one of the participants and daughter is a minority partner in funds, hence the mobility of the market should determine the demand of daughter funds.

- In the ESDM sector, the participation of EDF in Venture Capital Fund will be available in the ESDM region’s value chain and its ecosystem, including the necessary material technologies for Fabulous semiconductor start-up, research and development, electronic equipment, design and manufacturing and product design.

- The EDF, in some cases, can choose to cap its return from the daughter fund, provided the EDF has been given seniority on the payment out of the daughter fund.

- The EDF may also set up Daughter Funds with 100% funding if the products are of strategic importance and for which either there is not adequate commercial interest to participate or for which it is in the national interest to have fully Government owned fund for strategic reasons.

- According to SEBI, the manager or sponsor for AIF Regulation, 2012, Category I and II AIF, not less than 2.5% of current interest in AIF or 5 crores, whichever is lower and through such exemption of interest management fees Will not do.

Governance Mechanism

- To be eligible for support by the EDF, a daughter fund should be made within India according to Indian laws and regulations. The Fund Manager of the Daughter Fund shall ensure that the laws of the land are fully complied with, in respect to setting up and operation of the Fund. Offshore funds may ensure that necessary RBI / FIPB approval is obtained before they participate in any Venture Capital Fund in India.

- The Daughter Funds supported under the EDF should be professionally managed.

- The decision will be made by the EDF, policy of providing funding to daughter fund and how they should invest in the venture.

- EDF Management Board. The financial institution housing the EDF will set up a High-Level EDF Management Board including representatives of Department of Electronics and IT, Government of India. The roles and responsibilities of the High-Level EDF Management Board would, internal, include:

- Appraise and make recommendations to the Government for participation in the Daughter Funds.Make recommendation to the Government for release of funds to participate in the Daughter Funds.

- High-level monitoring of progress and performance of daughter fund.

5.The Daughter Funds should have a track record and investment experience in the relevant sector. The experience should be commensurate with the activities of the proposed Daughter Fund.

6.The Funds realized on exit from Daughter Funds would be recycled through the EDF.

Time Period

This policy will be available for approval of the new daughter fund till 31.3.2017. However, on approved 31.01.2017, daughter funds will be fully supported until the full support of the draft is granted.

The Department of Electronics and IT shall identify the financial institution to house the EDF and issue detailed guidelines for implementation of this policy after its approval.

Eligibility Criteria

- Any Daughter Fund which is registered in India and abides by relevant rules and regulations including the SEBI (Alternative Investment Funds) Regulations, 2012 (as Category I and II AIFs) and is set up to achieve the Fund objectives will be eligible for support from the Fund;

- The Daughter Funds supported under the EDF should be professionally managed;

- The Daughter Funds/ fund manager should have a track record and investment experience in the relevant sector in which it makes its investments. Experience should be in line with the activities of the proposed daughter fund;

- For a Daughter Fund, to be eligible for support by the Fund, it should be set up in India, as per the prevailing Indian laws and regulations. Fund Manager of Dutt Fund will ensure that the law of land fully complies with the establishment and operation of the fund.

Selection of Daughter Funds

The Investment Manager of the EDF will look for a combination of the following qualities in selecting fund managers/Daughter Funds including;

- Knowledgeable, experienced, and stable management team – The team should have technical people who understand the ESDM, Nano-electronics, IT and related sectors;

- Ability to network and raise the balance funding from other resources;

- Ability to align with the requirements of the EDF policy and to provide risk capital especially to companies developing new technologies in the area of ESDM, Nano-electronics, IT and related sectors;

- Stable and proven investment approach of the Daughter Fund/ fund manager;

- Rigorous due diligence methodology in selecting the Daughter Funds;

- To enter into a Documentation that protects EDF/Government of India interests;

- Ability to add value post-investment; Superior investment returns (absolute and relative);

- Evidence of value creation through operational improvement.

Investment Process

The Fund’s investment process/work plan will include:

Screening

The Investment Manager will employ a highly disciplined and established investment decision process. The Investment Manager will screen the proposals of various fund managers for raising monies for the Fund and select/ identify/ recommend the eligible proposals based on the management team, ability, fund focus, performance history, etc. Such evaluation shall principally be undertaken by the Management Team.

The Investment Manager will undertake the preliminary screening of the prospective daughter fund proposals through the in-house team of the Investment Manager.

Due Diligence

The Investment Manager’s approach to due diligence will ensure that it is focused on assessing and pricing the most critical risks and opportunity in all the Daughter Funds/fund managers which are assessed. The Investment Manager will pursue a thoughtful and disciplined due diligence process that will focus on establishing a thorough understanding of a manager’s strategy, technical knowledge, prior performance, expertise, portfolio management skills, value creation capabilities, administrative integrity and organizational stability.

EDF Management Board

Shortlisted prospective daughter funds will be placed before the Management Board for deliberation/discussion on the proposals. In-principle / Sanction letter will be issued to the approved Daughter Funds/fund managers.