About

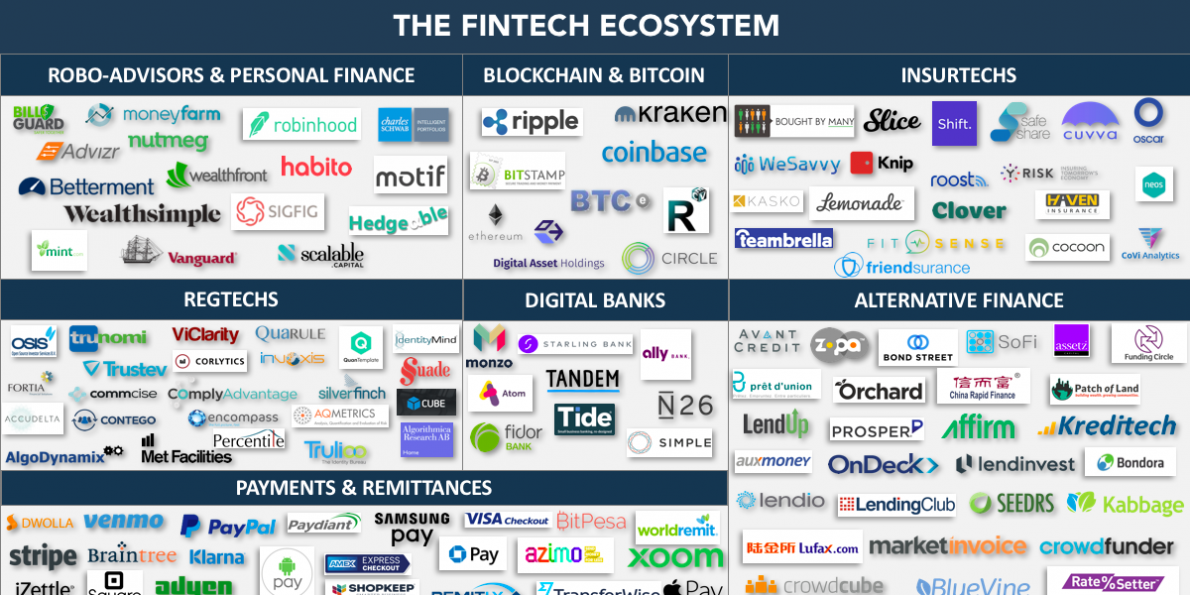

Software Fintech software market is expected to reach $ 2.4 billion by the current $ 1.2 billion to 2020. The transaction value for the Indian fintech sector is estimated to be approximate $33 billion in 2016 and is expected to reach $73 billion in 2020, According to a report by Fatech by KPMG, a 22% five-year computer is growing at an annual rate. Growth in smartphones and consumers’ willingness to transact online have spawned a large number of start-ups, all trying to take advantage of this opportunity. Here are 10 emerging fintech start-ups from India that are making a mark:

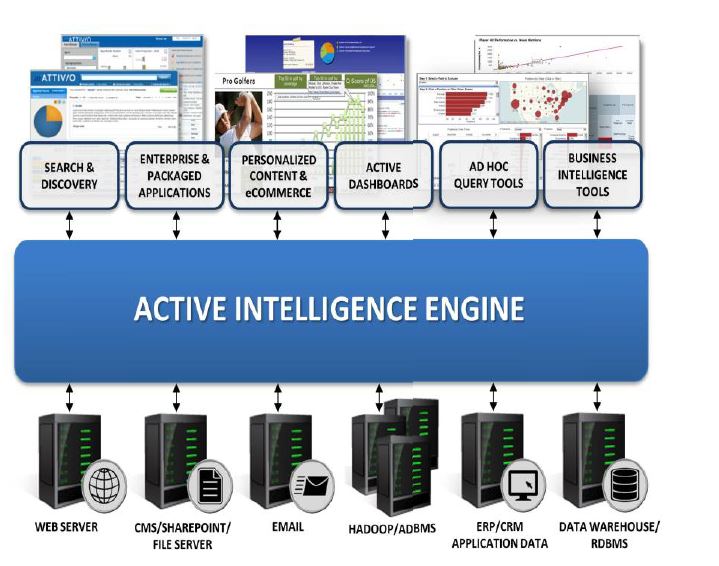

Active.Ai (Active Intelligence Pvt. Ltd.)

Founded: 2016

Funding: $500,000 from Kalaari Capital

About: Active.Ai is a platform that offers chat bots for large banks to interact with their customers in the format that they’re most comfortable with. The more customers interact with the application, the more the artificial intelligence behind it learns about them and offers personalized advice and service, increasing engagement and loyalty of the customers. The use cases range from getting the balance in the account to transferring money to friends and paying bills. The bot can be integrated via various channels, including We Chat, LINE, Kakao Talk, Facebook Messenger, Amazon Echo and Siri.

fonePaisa (fonePaisa Payment Solutions Pvt. Ltd)

Founded: 2014

About: fonePaisa offers multiple payments solutions. For an individual, it offers a wallet that aggregates the most popular payment options, including other wallets, enabling them to carry out transactions at various retailers and pay their utilities’ bills. For merchants, it offers a payment gateway to accept payments, and also offers them software to create loyalty programs, targeted marketing campaign, and shows merchants a consolidated reporting and monitoring dashboard. fonePaisa also offers businesses accounts receivable software that automates matching payments to invoices, eliminates manual processes and reduces costs.

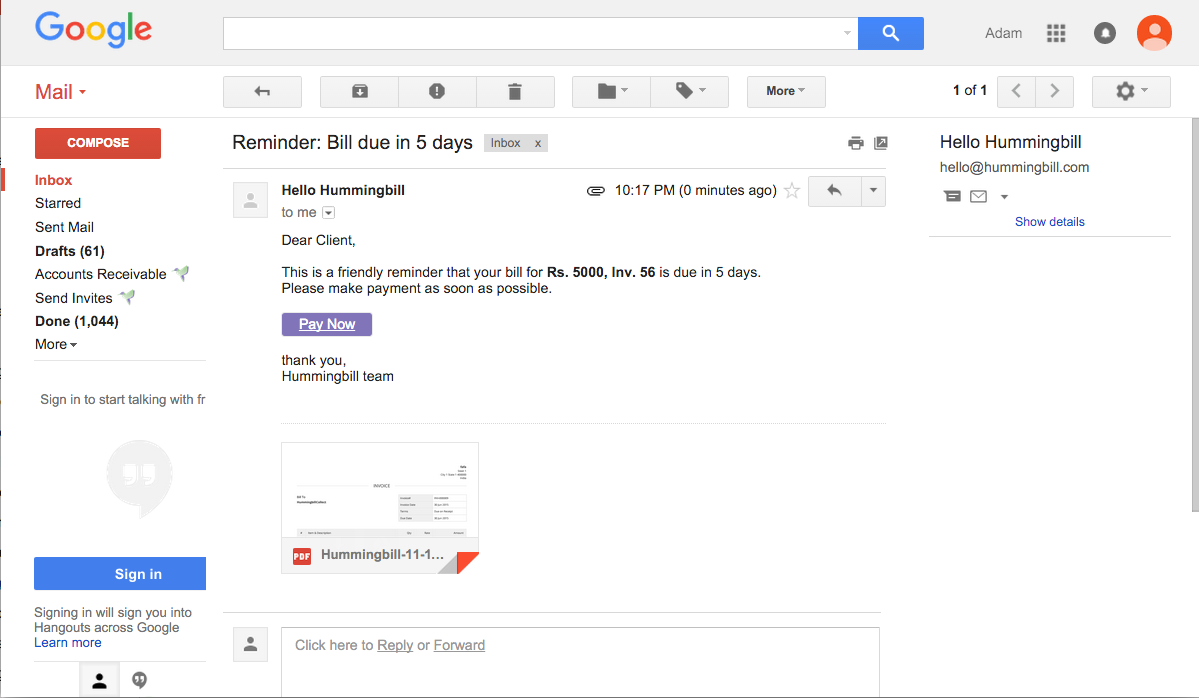

Hummingbill (Hummingbill Technologies India Pvt. Ltd)

Founded: 2015

About: Hummingbill helps in automating accounts for software acquiring attainable qualifications for small businesses. The biggest problem for small businesses is that they do not receive their payments on time, often due to clerical errors or logistics issues. Hummingbill is hoping to help financial officials and accountants to overcome this with a simple tool, its software works as a plugin for Gmail, which enables businesses to track invoices and invoices makes. It also allows one to automate payment reminders and track the collection performance of sales representatives and account managers.

mymoneysage.in (Shreem Datatech Solutions Pvt. Ltd)

Founded: 2015

About: This start-up offers a cloud-based money management software for individuals as well as financial advisers. Individuals can add their bank accounts, investment accounts, insurance accounts and get actionable advice from experts. For advisers, this works like a customer relationship management software where they can create and manage tasks, offers SMS and e-mail reminders about client and prospect meetings and a dashboard where they can manage all their client data in one place. It also helps them get more visibility in a marketplace it offers and acquire new clients.

SayPay Technologies Inc

Founded: 2013

About: SayPay Technologies is a biometric certification provider that especially works on identifying customers based on biometrics (with face-to-face identification). SayPay Technologies users speak a one-time code rather than a password, and also the start-up claims, this can be way more secure than the one-time-passwords that square measure in use. An entire transaction can be completed in seven seconds. The start-up, which has filed a patent for this technology, has partnered with two banks and is looking to partner with more. It says it can be extended to most financial transactions, including consumer bill payments, e-commerce, payment gateway integration, step-up authentication, P2P (peer-to-peer) transfers and corporate payment approvals. It works with feature phones as well as smartphones.

Scripbox (Scripbox.com India Pvt. Ltd)

Founded: 2012

Funding: Undisclosed amount from Omidyar Ventures and $2.5 million in Series A from Accel Partners.

About: The Scripps Box provides an online mutual fund investment platform for individuals when they sign up, then individuals can decide how much they want to invest – whether it is monthly or long-term equity, debt fund, and tax-saving fund or Equity Linked Savings is in the scheme. The user is chosen by the presented funding algorithm and there is no manual intervention. Scripbox does not charge users but a distributor from asset management companies makes money by getting a commission, however, there is no disturbance with them and they take a commission.

Senseforth (Senseforth Technologies Pvt. Ltd)

Founded: 2012

About: Sensefoth provides an artificial intelligent platform that can chat all the services of the bank. The platform, called Aware, has been benchmarked against various industry standards, and with initial claims, it is better performing in most cases. There are at least 12 different Boats in Senseforth which can act as a different assessment of the risks facing businesses and provide alerts to avoid adverse effects, related to the rules, standards, and administration of businesses. Helps in complying with issues, as well as advising their customers on structuring individual portfolios and on investment opportunities. It works with customers like HDFC Bank Limited and T-Mobile International AG.

Tauro Wealth (Tauro Investment Advisors Pvt. Ltd)

Founded: 2015

Funding: Undisclosed amount of seed funding from Tracxn Labs

About: Tauro Wealth is a Robo advisory start-up targeting individuals who are confused and intimidated by the stock markets and makes it simple for them to invest in a stock portfolio. Understanding these individuals gives a primer on what the stock investment is about and they are aware of the risks involved. Tauro Money generates portfolio by using proprietary algorithms to reduce manual intervention and remove human errors and personal prejudices. Tauro Wealth’s investment portfolios are built to achieve a mix of passive and active investment strategies.

ToneTag (Naffa Innovations Pvt Ltd)

Founded: 2013

Funding: $1 million from Reliance Capital Ltd

About: ToneTag provides an app that can enable contactless payments on any device—even a feature phone—bringing an Apple Pay like experience to millions of Indians, without having to add any infrastructure. This it will by use of sound waves to viable proximity-based payments. ToneTag talks to a merchant’s location system victimization encrypted sound waves and can work even with background signal. The system works even without mobile Internet. ToneTag offers a patent-pending software development kit that can be integrated into applications that would either accept payments based on tone or based on near-field communication depending on the merchant.

Unocoin (Unocoin Technologies Pvt. Ltd)

Founded: 2013

Funding: $250,000 from the Digital Currency Group

About: Unocoin operates a Bitcoin wallet that Indian users can use to sign up and buy or sell bitcoins. Unocoin is partnering with a peer-lending market, and wallet using various Bitcoin-related companies such as BTCjam, bitcoins worldwide, and Wallet, which translates Amazon gift cards to bitcoin and balance for the bucks.It has also partnered with wallet provider MobiKwik and lets its users transact on MobiKwik with the help of bitcoins. It launched a point-of-sale app for merchants to accept money through bitcoins.

How to Raise Funds for Your Fintech Business

Raising capital is a fundamental act of any start-up. Many fintech businesses fail during the first year of operation due to lack of funds. Money is the bloodline of any fintech business. Long-time exciting travel needs to be known as capital to benefit from the idea. That’s the reason, it is common to ask entrepreneurs at every stage of the Finitech business – how do I finance my start-up? They have several funding options for Fintech start-up that will help you raise money for your business.

1.Self-Funding

Self-funding is an effective way of financing your fintech business, especially when you are just starting your business. It is not easy to get money without first performing some plans for potential success, therefore, invest in your initial savings of Phoentek business or contribute to your family and friends. Self-fund should be considered as the first money option.

2.Crowdfunding

Recently, due to crowding in the form of a method of financing, it got very popular. It is like taking loans, investments or contributions from more than one person at the same time. This is how crowdfunding operates –Entrepreneur put up a detailed description of their business on a crowdfunding platform. They usually mention the business goals, plans to make a profit and how much funding they need. People always invest in a fintech business they really believe in. Kickstarter, Rocket Hub and Dream founded are some popular crowdfunding platforms.

3.Get Angel Investment

Angel investors are people with surplus money and a keen interest to invest in start-ups. They normally screen the business proposals before investing. The also provide advice or mentoring alongside capital.

4.Get Venture Capital

Venture capitalists invest in companies with huge potential, they usually invest in fin tech business against equity and are present where there is an acquisition. Venture work in the capitalists as a specialization, consultation, and examination of the lamp, where the FineTech business is growing, the business is evaluated from scalability and durability points.

5.Get Funding From Fintech Incubators & Accelerators

Early Stages Fintech businesses can consider accelerators and incubator programs as a financing option. These programs are found in many big cities to help initial businesses. Programs generally run for 4-8 months and require a time commitment from Finitech business owners.

6.Raise Capital By Winning Contests

There are many fintech contests that are helping to maximize the opportunities for fintech fundraising. They encourage entrepreneurs with the Finetech business ideas to start their own business. In such competition, there is a need to either prepare a business plan or make a product.

7.Raise Money via Bank Loans

Ordinarily, banks are the first place that people go when thinking about business capital. The bank offers two types of financing for fin tech businesses. One is funding, and the, while the evaluation other is working capital. Working capital loan is the loan needed to run the operation of generating a profit of a full cycle value of funds for banks is included in the process of sharing details and business plan, along with the project report. Sites like Kababi help a person to get working capital loans online in less than a few minutes.

Credit- live mint, tech bullion