Demonetisation has possibly been the single biggest policy brand this country has seen in 2016. It certainly was bigger than GST from an impact perspective. It is a policy initiative that in its current state looks terrible on implementation and weak on intent. As on date over 82 per cent of the total tender float is already back in the bank and there are another 10 days to go! In this backdrop, it is hard to imagine if a significant upside has been achieved through this policy initiative.

Narratives changed every single week over the last six weeks. What was told to the nation as an attack on unaccounted money is now being trumpeted as an honest effort to move towards a cashless economy. Every week one slogan took the ‘top of pop’ charts. The one slogan that retained the highest top billing was ‘short term pain and long term gain’. This slogan is designed to interpret just about anything. Let us examine all the pain and gain elements in this slogan.

When this policy was conceived India was motoring on a GDP growth rate of close to 7.5 percent. The US, which is India’s leading export market for services and super skilled professionals, had a new incumbent president. A president-elect who amongst others used the anti-outsourcing rhetoric to win the mandate. Britain, the other big western market for Indian businesses, was in a churn due to BREXIT. Germany and France are headed for elections in the near future. The OPEC policy on oil was to unfold etc. The global situation was stacked with uncertainty on policy. All these are indicators of uncertainty and were brazenly bold for Indian policy makers to not acknowledge. Demonetization for starters looked like a ‘rushed’ decision and was not thought through from all angles.

Locally, Inflation was getting back under control, the Central Bank had a new chief and the monetary policy implementation was taking shape. Banks were not in the best of health with serious NPA issues continuing to be in play. The central bank governor did not have much leverage to make drastic interest rate decisions. Select sectors like Infrastructure, construction, retail, healthcare energy at all of the Indian industry had started to look up, albeit slowly. Macro indicators were shaping for a consumption-led growth in India. Government’s policy initiatives on the growth sectors were taking shape and some certainty had begun to emerge. GST had moved from bill to implementation stage. Money markets were showing frugal signs of improvement in liquidity. The situation was fairly balanced and indicated towards an economic growth in early 2017.

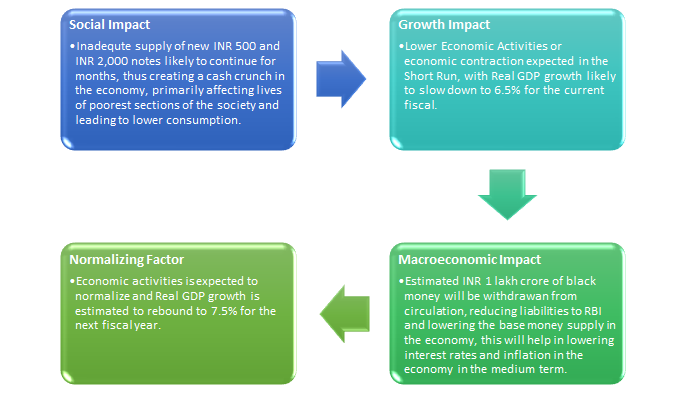

Then came the undercooked policy of demonetization. It touched and negatively impacted all the growth sectors as the last point transaction is cash led in most of the sectors that were looking up. Acceleration in economic progress came to a grinding halt! The economy got ‘pinched’ and the business throughput lost in the last 6 weeks will not be recovered in 6 months from now. It is not just the loss of throughput but the confidence that goes with it. Transactions and transaction mechanisms will get redefined. A ‘new reset’ has emerged in cash management. There is uncertainty in the entire system.

To compound matters further, GST is waiting to be introduced in the early part of 2017. US dollar which had begun to harden after elections in the US has hardened further after demonetization. Oil prices are headed northward after OPEC put a cap on production. Adequate cash is not available to farmers as they commence the sowing season. A new policy may emerge in the EU after elections in Germany and France. All these aspects will bring multiple dimensions of uncertainty to India’s monetary situation.

Having said that, the government has demonstrated clear intent and action to clean the monetary economy of this country and bring in a lot of transparency into the system. This intent cannot be disputed and the government should get credit for that. While the statement of intent has been very clearly articulated, the statement of purpose needs to be understood in perspective. That will help us appreciate the expected gains from the policy.

The narrative on gains can be classified under 3 categories – transparency improvement, reduction in tax burden for individuals and the most important gain is the fear it has created amongst tax evaders. If the government can accelerate investments in technology infrastructure and link up primary and secondary payment mechanisms across all value chains that matter, a significant progress can be made towards a cashless economic model. The process has started but will take time and investments. The government can provide tax stops only if a considerable amount of currency does not get swapped in the demonetization process. The currency that does not reach the bank will get reprinted by the government and will be used in the expenditure program. The biggest gain, however, is the fear this initiative has created amongst tax evaders and in the government’s communique “it is just the beginning”. Tax reporting and revenues will improve in subsequent years.

All the gains are contingent on the government’s ability to control corruption in its lower and higher offices. If corruption continues to flourish all the limited short term gains of demonetization will be lost and the only thing that would change for the better is the look and feel of the new currency bills!

Disclaimer: The views expressed in the article above are those of the authors’ and do not necessarily represent or reflect the views of this publishing house. Unless otherwise noted, the author is writing in his/her personal capacity. They are not intended and should not be thought to represent official ideas, attitudes, or policies of any agency or institution.

Credit – Businessworld