About

Enterprise Resource Planning (ERP) systems are incredibly important to manufacturing today. Looking back at the history of manufacturing solutions, the industry started with Manufacturing Resource Planning(MRP)-type systems for basic planning and optimization.These early systems focused on simple goals like reducing work-in-process and inventory while increasing on-time shipments.Today’s ERP systems have expanded beyond that basic manufacturing planning into enterprise optimization— which is critical to surviving.

Grab your favorite beverage – there’s a lot in here to digest as we dive deep into the mega trends occurring in Manufacturing ERP.

A review of recent news/briefings indicates the following:

- End of an era – Kennedy CEO, Chuck Berger, told that the firm is tired of changing their processes and business practices to fit their ERP. Older systems may have triggered some firms to change poor processes but they also forced a lot of companies to adopt processes that vendors designed, not the ones used by (or desired by) those same businesses. More sustainable ERP solutions, specially built on those open and rhythmic platforms, are the future. Andrew McCarthy of Plexus resonated these feelings.

- Single-Tenancy yielding to better cloud technology – For a time, manufacturers found few options out there in the cloud unless one count hosted solutions. Among those hosted solutions were mostly old on-premises products that were running in single-tenancy on anyone’s public cloud. Even these application software quasi-cloud firms have gotten the religion of late and have started to incorporate machine learning, multi-tenancy and more into their product lines. Microsoft has done a lot to facilitate these evolutionary changes old product lines are in flux today and their vendors are still trying to name some of Plex, Kennedy, and Rootstock to pure-play cloud ERP products.

- IoT gaining focus – It seems almost every vendor has an IoT (Internet of Things) story they want to tell you. Some vendors simply have a ‘direction’ with nothing usable yet. Some have built an interface that can accept some IoT data. But, the biggest issue with these functional extensions is that these systems often lack a platform, infrastructure, in-memory database (or the headop version), analysis, etc. needed to identify the anomalous data, process large volumes of data, trigger workflow/actions, etc. And these IOT Prasad may be limited ahead because the sellers want to limit the large data, which they only support sensor data of some capital assets on the plant floor. These vendors need time, a new strategy and new hardware, software and skills to handle other big data types especially non-structured data (e.g., satellite imagery, emails, video, texts, social sentiment, etc.). So to be clear, these nascent big data solutions are really an incremental or tangential move to big(ger) data with limited sensor data being the gateway mechanism. It’s not a full-on big data solution yet.The move by vendors into big data is a currently a student in incrementalism. These are baby steps that may only deliver small chunks of value to the right customer with the exact business need. For now, many vendors are providing “technical basis” to customers for Iot support, to help with data science, key performance metrics, workflow, etc. customers will need to engage with the vendor’s partners, management consultants, etc. For the most part, the IOT solutions are not out of the box, yet there are no complete solutions. For a glimpse of how the fuller solution looks like, check the uptake. IoT will be worth watching for vendors, integrators and software buyers. While many older estimates suggested there will be 50 billion or so connected devices by the year 2020, a more recent study pegs the device count at over 200 billion and McKinsey Global Institute believes this will generate global economic value approaching $11.1 trillion by 2025. This is the time of all the millions of ERP ‘advisors’ from where a large number is re-trained and the ERP gurus are again badges.

Megatrends

- The channel is changing – Several vendors I spoke with are actively recruiting different kinds of partners. Many (such as Vermes and Plexes, only to name two) want to not reunite the cloud-resident old-school on-premises resellers, consultants or implementers. Some want management consultants (not integrators) who understand the KPIs and industry metrics of their intended customers (a key skill set in a world becoming more digitally empowered). Management consultants are needed to help identify what data and metrics are needed to make sense of IoT and other big data. One inescapable observation though is that old-school partners like business process outsourcers, offshore firms, old-line on-premises application integrators, etc. are passé. Neither the customers nor the vendors require any of these people (any) more, which, in any case, is to be considered as Phill Fhercht.

- Infrastructure is front and center – Big data processing power via a cloud service (think Microsoft Azure, Amazon AWS, Oracle, Google, etc.) is becoming an essential ingredient to any new ERP solution. Businesses know they’ll want to pump ever growing volumes of net-new kinds of data into their analytic tools. To understand these new, large data types, they will need scalable, cheap, utility-style raw computing power. Ideally, ERP buyers want their operational, financial, customer, web, sensor, machine, dark, external and other data types in one spot where all of their reporting and analysis can occur. They don’t need some of the data in a cloud, other in the different cloud, still more data on-premises, etc. This recent NetSuite graphic illustrates the problem.

- Increasing platform importance – Platform accelerates the delivery of many things: Software Institutions for new customers; Integration with other solutions; And solutions development for vendors, partners, and customers. Proprietary or Closed platforms are going the way of the Dodo. Platforms ought to be receptive third parties, customers, and channel partners to make new vertical/micro-vertical applications, new resolution extensions, new analytics/algorithms, new metrics, new workflows/processes/controls, etc. Any vendor that thinks a closed or proprietary platform is great is guilty of the worst kind of hubris.

- Customer satisfaction/experience is a real problem in the ERP – I want to be able to get software CEO with me when I meet firms’ executive teams or CIO places. These people are frightened by raising a new ERP solution terribly, from whom they had already dealt with. They’ve been audited (often too oft and too aggressively), tricked into paying maintenance on the unused package, forced to sign new (less favorable) contracts to mitigate some audit slight, and, in some cases litigated. high executives need to wear down their existing ERP vendor the maximum amount as you or I need to be ‘involuntarily re-accommodated’ off a United.

- There is a replacement activity but buyers are careful – they do not want to get sales / refinancing from ERP software. They do not want to roll up ERP vendors, who have many products and product lines from time to time for fashion. Likewise, they really don’t want private equity funded software companies. These buyers know that many PE companies suffering from debt on these companies take money from R & D and innovation. Today’s ERP buyers want consistency and focus, they do not want a revolving proprietary chain and do not want to flag R & B support.

- Business, as usual, is a drag on the new ERP sale – there is no wonder here. Businesses are not leaving their old trustworthy ERP unless there is a better economics better than a physically better solution. In this game, loser ERP vendors may be established which continue to maintain that same effective pricing as their old on-premises solution.The economies of scale they derive from multi-tenancy, commodity cloud computing, hardware deflation, etc. are not being passed onto customers.

Conclusions –

Conclusions –

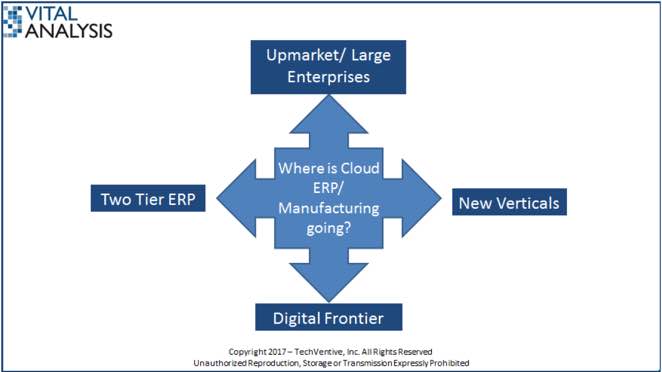

So, as we end part one, what can be concluded? Well, this much is clear:

- Transition in the completely digital ERP world is still emerging while using IOT as an investigation of innovation with some companies. Unfortunately, booting to IOT capabilities for old school ERP will not work as a major data solution because it lacks raw computing power, in-memory speed, scalable memory/memory, etc.

- The transition will be hard for old-line vendors who are still trying to have their cake and eat it too. They’re still attempting to support and maintain recent versions of on-premises solutions (some supply ‘unlimited’ support for these drains on R&D). Some are trying to postpone the inevitable re-platforming and re-creation of their software to work in a digital world where the data dictionary contains more than internal transaction fields. All of this stalling may help short-term earnings but it’s not helping customers with real and modern business needs today.

- New vendors may be small but if they do a lot of work for new customers, then they should not have any problem in taking physical market share away from the poor practices of old school firms.

Credit – Digi Nomi ca