Union Budget 2017 For Small Business And Start-ups

Union budget is one of the biggest events in the financial calendar of the country and this year’s financial budget saw some great promises made for empowering the small and medium-sized enterprises (SMEs) and the start-up businesses. The finance minister announced some great tax exemptions and policies for the small businesses and startup companies that the startup ecosystem in India will truly cheer in the upcoming days. However, there was no mention of angel tax which is an important factor that affects the start-ups in their early days and this has disappointed many start-up business owners in the Indian diasporas.

5 Key Announcements From Budget 2017 For Businesses

1) Reduction in Income tax rate to 25% for domestic companies

The Corporate India had expected reduction in Income Tax rate over the years but this announcement has come as positive surprise. The corporates having revenues less than Rs. 50 Cr will be paying income tax at the rate of 25% as against the current rate of 30%. This 5% reduction in tax rate is going to affect 96% of Indian companies. This will encourage the business owners to adopt better legal structures which may increase compliances but the benefit of tax reduction is a motivation to stay organised.

2) Reduction for presumptive taxation rate by 2%

The businesses that have turnover up to Rs. 2 crore have option to pay Income Tax under presumptive tax rate of 8% of turnover as per section 44AD of the Income Tax Act. With this new announcement, the tax rate will be 6% for the total turnover of the assessee, instead of 8% only if gross receipts are received through digital means. This announcement encourages the digital use for transactions, increases transparency in operations and gives relief to the new age businesses which relies on digital modes for business operation.

3) Extension of Income Tax holiday Start-ups

The startup companies will now have to pay tax for only three years out of the seven years tenure if only they make profits. Thus, this announcement made in the financial budget of 2017 makes it easy for the startup businesses to freely breathe in the Indian business market and give more attention to growing their business. This tax benefit is available to the businesses which are recognised by the DIPP (Department of Industrial Policy & Promotion).

The start-ups needs to meet the definition given by DIPP and the application then will be reviewed by a three-member inter-ministerial panel comprising a joint secretary from DIPP and representatives from the Department of Biotechnology and Department of Science and Technology.

The panel meets once a month to decide on applications based on how innovative a start-up is. This process is designed to ensure that the provisions are not mis-used. Its hard fact to know that only 8 start-ups were allowed to avail the tax rebate in 2016 out of 111 applications received, according to data on the Start-up India website.

4) Extension of Minimum Alternate Tax (MAT)

There are corporates which make high profits but have no taxable income because of exemption, deductions and incentives. MAT is introduced to ensure that tax is levied on such corporates by way of specific calculation. It’s a way of making companies pay minimum amount of tax. It is applicable to all companies except those engaged in infrastructure and power sectors.

The corporates have been demanding removal of MAT provisions. Mr. Arun Jaitley, has allowed the companies to carry forward their MAT to 15 years from the present period of five years. This provides the companies an additional five years before they become liable to pay their MAT as per the provisions.

5) Relaxation for Carry forward of Losses in case of lesser promoter voting rights

As per the Income Tax Act, the carry forward of losses in business is allowed for up to 8 years. For the purpose of carry forward of losses in respect of start-ups, the condition of continuous holding of 51% of voting rights has been relaxed subject to the condition that the holding of the original promoter/promoters continues.

The businesses are affected most by the Indirect Taxes and there has been no significant announcement for same in this year’s budget. This is due to the upcoming roll out of whole new frame work of Indirect Taxation called as Goods and Service Tax (GST) which is expected to be implemented from 1st July 2017.

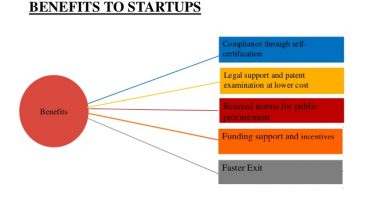

There are several other announcements made in the Union budget that will benefit the SMEs, MSMEs and the start-ups greatly. What are those benefits? Have a look at the list below to know the advantages:

Infrastructure Investment

The union budget of 2017 puts a lot of stress on empowering the infrastructure of different sectors of the economy so that the small businesses can invest themselves in different types of works and thus can grow sustainable. The growth in the infrastructure provides the small business to indulge themselves in different types of work by getting the contracts. In this way, they will be able to maximize their profits while ensuring the growth as well as the success of their business within a very short amount of time.

With this year’s union budget, the Central Government has taken the pledge to provide the electricity to all the rural sectors of the country by 2019. This will create a lot of work opportunities for the small businesses as they will be able to bid tenders from the state electricity boards or the state governments directly to supply with equipment or infrastructure to make this government project successful.

The budget also has shade some light on the development of the railway sector. The Government has plans to re-developing over 25 stations in the country, adding escalators or lifts to more than 500 stations for making them easily accessible for the people and Indian Government has also plans for making at least 500 stations easily accessible for the people who are disabled or differently-abled. That means the railway sector will also produce huge work opportunities for the small and medium size enterprises that work in contract with the railway department or are willing to take up those contracts for redeveloping or boosting the infrastructure of the railway stations.

Stress on the GST

One thing has been clear from the union budget that the Government is shifting much of its focus on the GST issue. The Government is planning to make changes in the way the indirect taxes in our country works for the betterment of the MSME as well the SME sector.

The finance ministry very well understands the importance of the small industries in the growth of the Indian economy; hence, they are providing much effort to pass the GST bill and to implement it. Once the GST is implemented in the Indian tax structure then it will completely change the way the taxes work in the country. However, the MSME owners or the small business owners are very much sceptical about the GST bill but the Government plans to overcome it by creating more awareness among the people.

The implementation of the GST will not only make changes to the working of the indirect taxes but will also help the small business owners to grow their business in all the frontiers. It will maximise the profits for the start-ups and will aid them to play a more determining role in shaping the economy for the better.

Automation in the approval of the FDIs

The finance budget clearly indicated the plans of the Government to make India more friendly nation for the foreign investors. Due to the regulation on the FDIs, the small businesses used to face various problems to find the funding for their businesses. But the government has decided to abolish the FIPB or the Foreign Investment Promotion Board which was in charge of controlling the foreign investments in the country. In doing so the FDIs will now become automatic and this will only benefit the small and medium enterprises.

From now on the small business owners will not have to go through a long and demoralising process for getting adequate funding for their business rather they will be able to find investment from the foreign investors thereby securing the sustainable growth for their businesses.

Emphasis on the skill training

Every small and medium enterprise requires labours to get their processes completed properly. Without a proper workforce, a company can never find success. But the untrained and unskilled labours makes it more challenging for the small business owners as it reduces the work efficiency of the enterprises greatly. Moreover, the small business owners face huge losses due to the unskilled workforce since they do not get what they are paying for. Thus, they require arranging special training sessions to make the workers skilled enough to establish a proper work culture within the enterprise.

The budget clearly indicated the government’s intentions to get this problem resolved and to push the idea of industrial skill training forward to make it easy for the small business owners to get a skilled workforce. To realise this plan the budget has sanctioned INR 2200 crore for providing the proper industrial training to the labours to make the skilled workforce accessible for the small businesses. Moreover, the SMEs that are indulged in providing the industrial training will also get benefitted from this arrangement.

Special incentives for the SMEs in the pharmaceutical sector

The small businesses in the pharmaceutical sector that manufacture the generic drugs and medicines used to be seriously outpaced by the large pharmaceutical companies and thus generating adequate profit from the business was a big problem.

The financial budget of 2017 introduced some new policies to reduce the costs of the medicines and this policy of the Indian government is going to prove as a huge win for the small businesses in the pharmaceutical sector. With the popularisation of the concept of generic drugs in the market for reducing the prices the sale of the SMEs will get a huge boost and the owners of these small businesses will finally be able to gain huge profits.

Development in the property construction sector

Union budget has also allocated more than Rs 64,000 for the development of the highways. Moreover, the union budget has sanctioned the development of more than 2000 roads in the coast areas which have separately identified by the government. Small businesses that take up construction, as well as maintenance contracts, will only be benefitted from these sanctions.

The opportunities for the small and medium enterprises as well as the start-ups will only increase in the upcoming days. The small business owners will have the opportunity to plan their steps well and take up the suitable contracts for the sake of their companies. The finance minister has also announced that the government is planning to give the affordable housing an industrial status and they are aiming to build over 1 crore houses by 2019 during the budget publication in the parliament. This is a massive project and the SMEs, as well as the start-ups, will be beneficiaries here since they will able to get several contract jobs in this

Promoting digitalisation in the SME and MSME sector

Following the events of the demonetization to fight the corruption in the country, the intentions of the government were very clear that they want to make India cashless by promoting the digital transactions in order to minimise the influence of the black money. The Union budget for this year also made a similar point in promoting the digitalisation throughout the country.

It will also help the start-ups and the small businesses that are struggling seriously in order to make a mark in the online sector. The e-retail business is going to be the next big thing in the Indian economy thus the start-ups that have not yet made their place in the online platforms will vouch for the e-retailing in order to increase their sales as well as the profits.

Development of oil reserves

During the budget discussion in the parliament, Finance Minister announced that government is going to develop new oil reserves in the areas of Odisha and Rajasthan. This will impact the small business owners directly as they will be able to get new contract works from the Government. Be it developing the infrastructure or delivery of machinery, the small businesses will be able to enjoy maximum benefits from this plan that the budget 2017 introduced.

Credit – Profitbooks