India has enjoyed a good year and we expect the country to continue with its positive growth, largely unaffected by the global economic slowdown, due to the continued influx of foreign direct investment under the government’s “Make in India” campaign.

Manufacturing output has already increased, with new orders coming from overseas firms seeking to utilise India’s vast resources and labour pool. More foreign companies are also investing in India’s fast-expanding infrastructure and renewable energy sector. We expect this investment to increase as electricity demand in the city rises and as the government prepares to streamline the country’s tax processes.

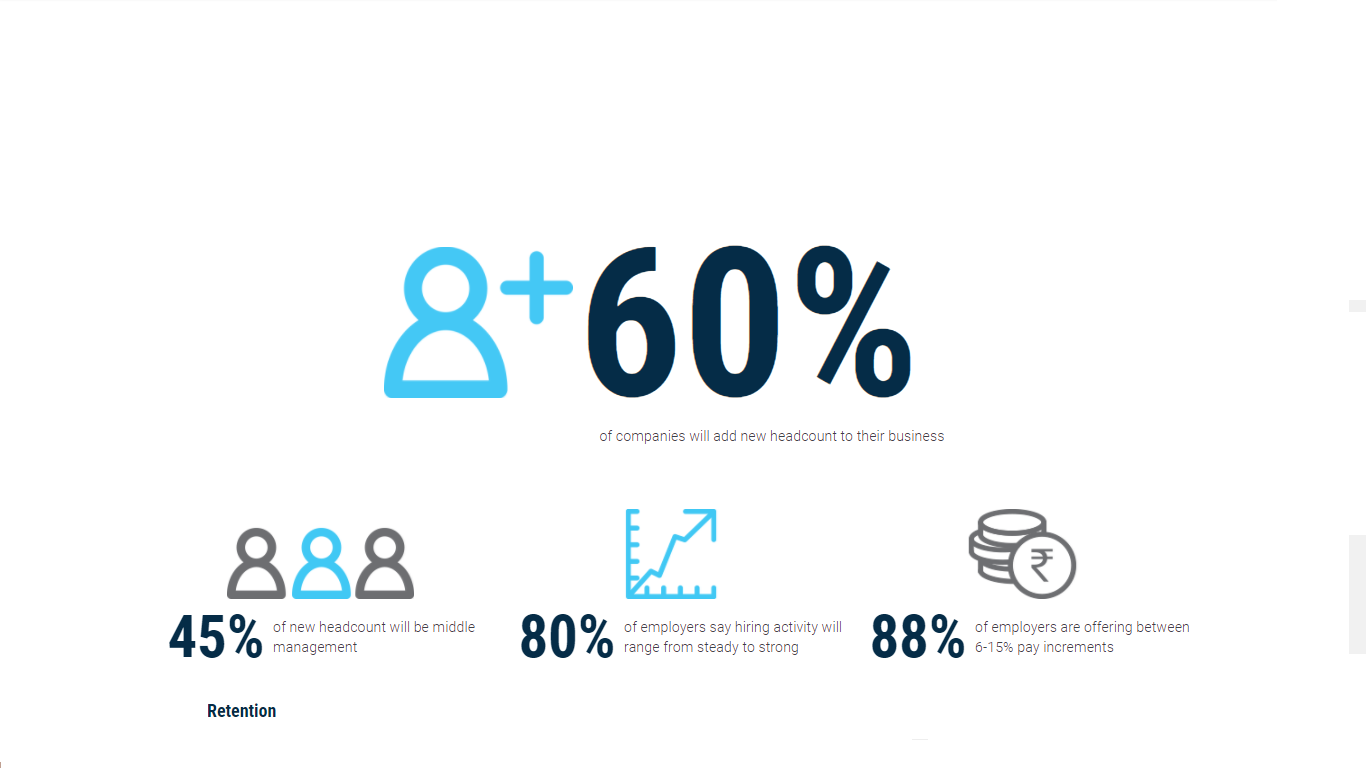

Companies’ employment outlooks are also reflecting this positivity. A huge majority (80 per cent) of employers surveyed say hiring activity will range from steady to strong over the next 12 months — numbers that are higher than the Asia average.

Key sectors that are experiencing solid growth include the financial services sector, as more non-banking financial companies (NBFCs) establish themselves in Mumbai, the nation’s economic capital. NBFCs are seen as popular lending alternatives for entrepreneurs and small and medium-sized enterprises that experience difficulties securing loans from traditional banks.

Outlook for the healthcare sector remains favourable, again facilitated by the relative low cost of pharmaceutical talent in India, market dominance of cheaper generic medicines and encouragement from the government to manufacture more active pharmaceutical ingredients.

While e-commerce thrived last year, we have seen this sector stabilise somewhat. Investors are exercising caution, choosing to invest in sustainable businesses instead of seemingly volatile start-ups. Still, the industry continues to attract top Indian talent currently based overseas, with many returning to the country to set up or join technology and engineering ventures.

While e-commerce thrived last year, we have seen this sector stabilise somewhat. Investors are exercising caution, choosing to invest in sustainable businesses instead of seemingly volatile start-ups. Still, the industry continues to attract top Indian talent currently based overseas, with many returning to the country to set up or join technology and engineering ventures.

Domestic consumption in the country is also rising, with India’s growing middle class leading demands. However, with more players now fighting for market share, competition within the fast-moving consumer goods sector has also increased. As a result, companies’ growth expectations have taken a bearish turn.

Talent shortages are most evident in the fast-growing supply chain and logistics sector, especially for senior-level plant managers. Rapid growth and an overall shortage of skills mean there is intense competition for high-calibre candidates. 60 per cent of companies are expecting to increase headcount, with middle managers comprising 45 per cent of these new employees.

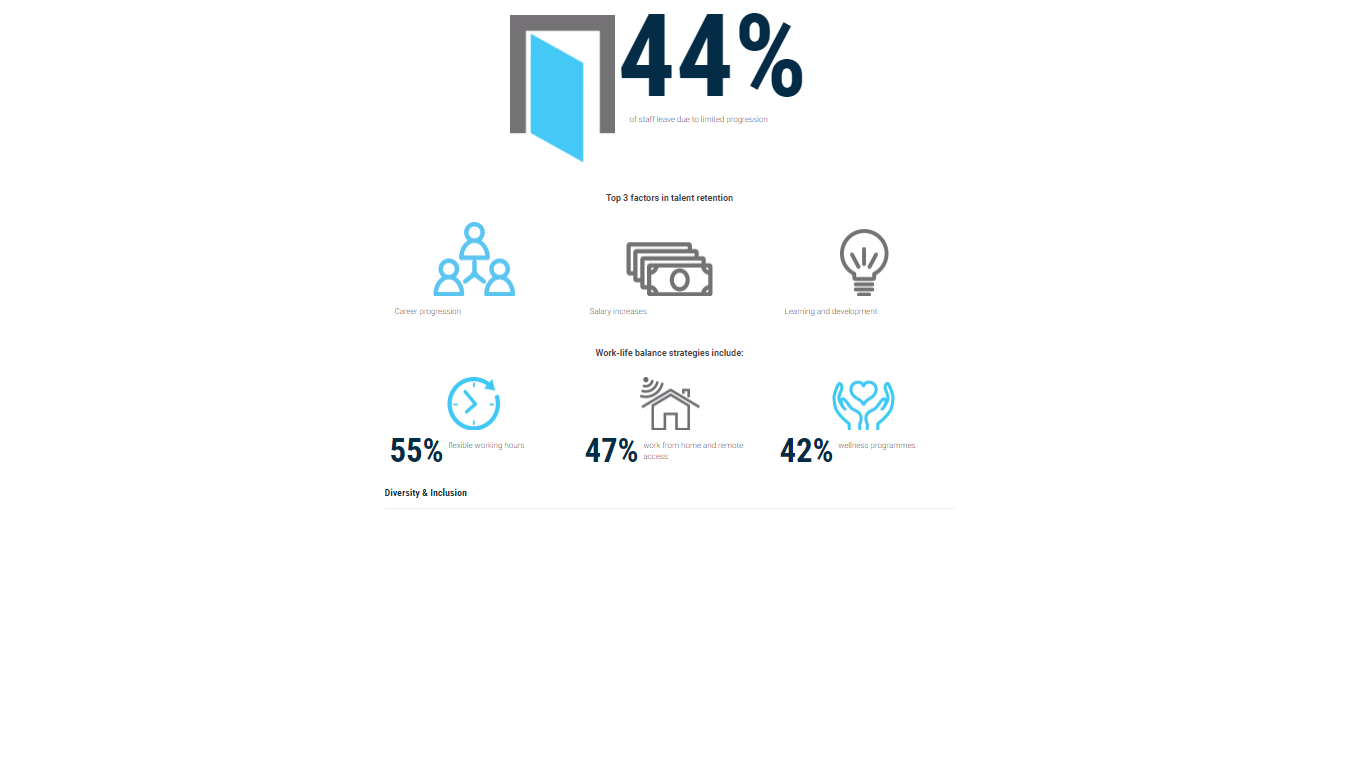

To attract and retain employees, a large majority (79 per cent) of employers are looking to structure clear progression paths. The key will then be to continue prioritising internal development programmes in order to retain the best talent.

One interesting observation is that companies are also going beyond gender when addressing workplace diversity. Gradually, more employers are looking to foster an environment where employees, regardless of race, age and abilities, can succeed at the highest levels. This progressive outlook will help engender innovation and productivity. Survey results show that 83 per cent of companies have placed diversity on medium to high priority.

Credit – Michaelpage