INTRODUCTION

The current Indian economic climate is ripe with opportunity for individuals ready to strike out on their own with a great business idea. You should, however, do some homework on starting a small business before you embark on this journey. In this post, we bring you a quick guide on what you need to consider when starting a small business in India.

The steps in starting a small business include creating a viable business plan, doing the relevant market research, finalizing funding sources and pinning down the business model. Once you have validated your idea with these steps, you will have to undertake the legal formalities of setting up a business in the country.

Your business may be of one of the following types:

- Sole Proprietorship – a business run only by you, which mostly do not require registrations

- Partnership – a business run by more than one person, with responsibilities and revenues shared between them

- Limited Liability Partnership – a partnership business run by multiple people, with individual and limited responsibilities but not liable for others’ decisions

- Private Limited Company – a business held privately by you and/or your partners and cannot have:

More than 50 shareholders

Public trading of shares. - Public Limited Company – a business registered under the Companies Act (1980) having:

Necessary capital requirements

Public trading of shares

Once you have chosen the type of business you will start, the following sections will tell you how to go about starting a small business:

Digital Signature Certificate

Obtain a Digital Signature Certificate (DSC) from any of the MCA-authorised agencies, which will take about 2 – 5 days.

Company Incorporation:

Once you have received your DSC, it is time to prepare the incorporation of your small business with the INC-29.

Obtain a Director Identification Number (DIN) online from the Ministry of Corporate Affairs portal

File the desired company name with the Registrar of Companies on the MCA website and make sure it is available for use

Submit the main objectives of the company to the Registrar of Companies (ROC) for scrutiny and approval

Finalize the following documents, usually drafted by the Company Secretary:

Memorandum of Association which lists the main, ancillary, subsidiary, and other parts of the company as well as the authorized share capital of the company and the names of its first directors

Article of Association which describes the rules and procedures for the routine conduct of the company

Register your office address and, submit letters odd declaration and appointments of the board of directors

Payment of Fees:

Once you have got your business incorporated, you will have to pay the necessary fees and stamp duty before filing the Inc 29, which will be as below (base capital you invest):

Rupees 100,000 – Rupees 5,000

For every Rupees 100,000 of authorized capital up to Rupees 500,000 – Rupees 4,000

For every Rupees 100,000 of authorized capital up to Rupees 50,00,000 – Rupees 3,000

For every Rupees 100,000 of authorized capital up to Rupees 100,00,000 – Rupees 1,000

For every Rupees 100,000 of authorized capital over Rupees 100,00,000 – Rupees 750

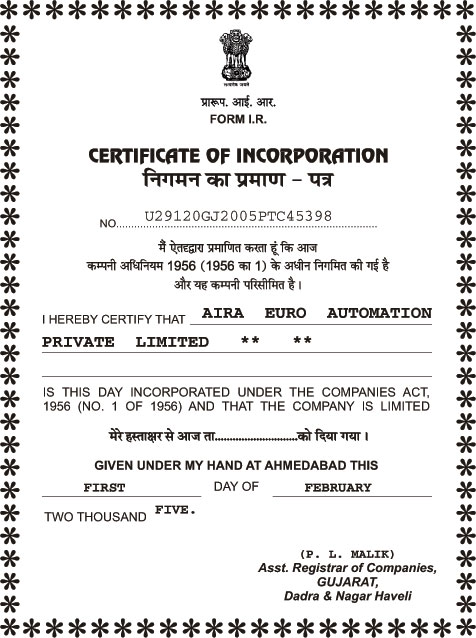

Certificate of Incorporation:

You will have to submit digital and physical copies of the following documents to the ROC to get your Certificate of Incorporation:

Forms e-form 1 (stating that all requirements of the incorporation process have been completed), e-form 18 (informing the ROC of the location of the registered office of the company) and e-form 32 (stating the appointment of proposed directors) which have to be filed electronically

Signed and stamped forms of the Memorandum and Articles of Association

Initial consent of directors

Original approval of name letter

Stamped Power of Attorney documents

Income Tax Registrations:

Once you have incorporated your small business, you will need to register with the relevant tax authorities that would help you with starting a small business.

Permanent Account Number (PAN) which can be obtained by filing an application with the Income Tax Department using Form 49A along with supporting documents

Tax Account Number (TAN) which is required for anyone responsible for deducting or collecting the tax. You will have to use Form 49B for this and submit it at any TIN Facilitation Centre authorized to receive e-TDS returns

You will also have to register for a Value-Added Tax (VAT) number as well as other tax requirements such as professional tax and service tax

Labor Law Procedures:

These rules define the basic employee policies which need to be in place for any business.

Registration with the Office of Inspector, Shops, and Establishment Act

Registration with the Employees’ Provident Fund Organisation if you have more than 20 employees

Registration with the Employees’ State Insurance Corporation, a social security scheme to provide protection to workers in the organized sector and their dependents in contingencies such as sickness, maternity, death, disablement, or occupational disease

The steps and procedures described above may vary depending on the state and type of business. Tackle these in a proactive and systematic manner to ensure you don’t get caught in a legal tangle that will delay the launch of your business or hamper its operation. The sooner you get it registered, the sooner your business will start rolling!

Credit- QuickBooks